If you want to hire a financial advisor, you have to pay them a fee. There are many different types of fees, but one of the most common is the annual retainer fee, which is anywhere from $6,000 to $11,000 per year. There are many compensation options, including hourly and fixed-fee rates. Here are some guidelines:

2% - 3%

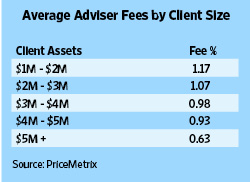

The average fees for financial advisers is between 2% and 3%. However, this does not reflect the true cost of services. Despite high fees, the vast majority of advisers charge between 1 percent and 2 percent of clients' assets. This number rises to 18% for clients who have assets in excess of $1 million. While most advisers will charge between 1 to 2 percent, there are some that charge much more. AUM fees are the most popular type of fee for financial planning.

There are many factors that influence how much an advisor will charge. Advisors may charge a percentage or adjusted gross income. Other advisors may charge a flat rate or a percentage for assets under management. Other fees can be flat or charged only if the client's AUM meets certain benchmarks. The more extensive the service and advice that a client receives, the higher the fee.

$6,000 to $11,000 per Year

Some financial advisors offer full services that include creating a financial plan for you, while others only provide oversight. Advisors may charge flat fees for financial advice and plan creation. These fees generally range between $1,000 and $3,000.

Although the fee for managing an active portfolio is more expensive than one managed inactively, it is still less than that of an active investor manager. The funds are usually managed by an investment manager who oversees the performance of the portfolio. They generally outperform benchmark indexes such as the S&P 500. However, it is important to know the types of securities your advisor will be investing before signing up for this type service. It is important to determine whether the investments are in accordance with your long-term goals. Also consider how much risk your willingness to take.

Hourly

Many people assume that financial advisors charge an hourly fee based on the amount of time they spend with each customer. It isn't true. Kitces Research recently found that the cost of a financial advisor was not directly proportional to the time required to create a plan. It found no statistically significant relationship between these two. Instead, those who are certified are charged more than those who don't.

When considering hourly fees, it's important to remember that these are not directly tied to the value of your investments. The hourly rates for financial planners depend on how much time they have available and the value of your investments. These rates can also differ from advisor-to-advisor. Additionally, project-based fees may be helpful if you're seeking an advisor for a particular project. This is a good option if you don't know the person well and are just looking for some advice. You should make sure that you select an advisor with clearly defined deliverables.

Annual retainer payment

Financial professionals are increasingly exploring the idea of an annual retainer fee. These fees offer clients security and help minimize financial planning disruptions due to cost-related issues. They work in the same way as subscription pricing. They also provide steady income. Here are some benefits of an annual retainer fee for financial advisors. This pricing model is great for building long-lasting relationships with clients as well as growing wealth.

First, the annual retainer fees have become more consistent than in the past. Some advisors charge an hourly rate that is based on AUM. Other advisors may charge an annual retainer, which can be anywhere between $6,000 and $11,000 depending upon the service. Investors need to be aware of the difference between a fee only and a commission-based advisory.

FAQ

Is it worth using a wealth manager?

Wealth management services should assist you in making better financial decisions about how to invest your money. It should also advise what types of investments are best for you. This way you will have all the information necessary to make an informed decision.

There are many things to take into consideration before you hire a wealth manager. You should also consider whether or not you feel confident in the company offering the service. Are they able to react quickly when things go wrong Can they explain what they're doing in plain English?

What are the advantages of wealth management?

Wealth management offers the advantage that you can access financial services at any hour. Saving for your future doesn't require you to wait until retirement. It's also an option if you need to save money for a rainy or uncertain day.

To get the best out of your savings, you can invest it in different ways.

You could invest your money in bonds or shares to make interest. You could also buy property to increase income.

If you hire a wealth management company, you will have someone else managing your money. You don't have to worry about protecting your investments.

Which are the best strategies for building wealth?

It is essential to create an environment that allows you to succeed. You don't need to look for the money. If you don't take care, you'll waste your time trying to find ways to make money rather than creating wealth.

It is also important to avoid going into debt. It's very tempting to borrow money, but if you're going to borrow money, you should pay back what you owe as soon as possible.

You set yourself up for failure by not having enough money to cover your living costs. And when you fail, there won't be anything left over to save for retirement.

So, before you start saving money, you must ensure you have enough money to live off of.

What is risk management in investment administration?

Risk management is the act of assessing and mitigating potential losses. It involves monitoring, analyzing, and controlling the risks.

A key part of any investment strategy is risk mitigation. The purpose of risk management, is to minimize loss and maximize return.

These are the main elements of risk-management

-

Identifying risk sources

-

Monitoring and measuring the risk

-

How to reduce the risk

-

Manage your risk

How to Begin Your Search for A Wealth Management Service

If you are looking for a wealth management company, make sure it meets these criteria:

-

Proven track record

-

Is based locally

-

Offers complimentary initial consultations

-

Supports you on an ongoing basis

-

Is there a clear fee structure

-

Excellent reputation

-

It is simple to contact

-

We offer 24/7 customer service

-

A variety of products are available

-

Charges low fees

-

No hidden fees

-

Doesn't require large upfront deposits

-

A clear plan for your finances

-

Transparent approach to managing money

-

This makes it easy to ask questions

-

Have a good understanding of your current situation

-

Understand your goals & objectives

-

Are you open to working with you frequently?

-

Work within your budget

-

Has a good understanding of the local market

-

You are available to receive advice regarding how to change your portfolio

-

Will you be able to set realistic expectations

Who should use a wealth manager?

Everybody who desires to build wealth must be aware of the risks.

Investors who are not familiar with risk may not be able to understand it. Poor investment decisions can lead to financial loss.

People who are already wealthy can feel the same. Some may believe they have enough money that will last them a lifetime. This is not always true and they may lose everything if it's not.

Everyone must take into account their individual circumstances before making a decision about whether to hire a wealth manager.

Statistics

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to save money on salary

You must work hard to save money and not lose your salary. If you want to save money from your salary, then you must follow these steps :

-

Start working earlier.

-

You should reduce unnecessary expenses.

-

Online shopping sites such as Amazon and Flipkart are a good option.

-

You should complete your homework at the end of the day.

-

Take care of your health.

-

Increase your income.

-

You should live a frugal lifestyle.

-

Learn new things.

-

It is important to share your knowledge.

-

Read books often.

-

Rich people should be your friends.

-

Every month you should save money.

-

Save money for rainy day expenses

-

It's important to plan for your future.

-

It is important not to waste your time.

-

You must think positively.

-

You should try to avoid negative thoughts.

-

You should give priority to God and religion.

-

Maintaining good relationships with others is important.

-

You should enjoy your hobbies.

-

You should try to become self-reliant.

-

You should spend less than what you earn.

-

You should keep yourself busy.

-

You must be patient.

-

You must always remember that someday everything will stop. It's better if you are prepared.

-

You should never borrow money from banks.

-

Problems should be solved before they arise.

-

It is important to continue your education.

-

It is important to manage your finances well.

-

It is important to be open with others.