Syncrm Software, Midwinter, AdviserLogic and Syncrm are just a few of many financial planner software providers that have been making a name for themselves in the industry. Sage's Prospero Wealth Management (Sage) and Navigator n-link (Navigator) are other software providers. These providers are not the only ones that exist. There are also smaller players that don't want to miss the opportunity created by the changes in the financial planning industry.

It's easy to use

Small and mid-sized firms can use financial planning software to track client assets. You can select software that suits your needs but some programs are easy to use and flexible. Some programs allow for basic assumptions of tax rates. Other programs take your inputs to a higher level and let you model actual tax brackets.

The price of financial planner software depends on the features you need to access. A year's subscription costs between $900 and $1500. The number advisors using the program drives the price differences. There are companies that deliberately price their software lower in order to attract more customers.

Integrates with investment platform

Integrating with an investment platform makes the process of implementing and managing complex investment strategies easy. Elwood's comprehensive solution offers deep liquidity, comprehensive market data, and a gateway to institutional access to digital assets. Elwood's platform allows for powerful trading and investment management. It offers direct investing in mutual funds, ETFs and equities. Its workflow tools are easy to use, while the rules-based engine makes it possible to manage investments easily.

Integration enables the platform to manage multiple accounts in one place and allows for consistent rebalancing across all accounts. You can take advantage all opportunities across all assets. By integrating your accounts, you will be able to reduce the risk of missing out on opportunities. Also, by managing all your accounts within the same system, you'll be able to monitor each component, allowing for ongoing rebalancing and adjustments.

Prices

Software that helps with financial planning is powerful. There are many options available, each offering its own distinct features. Some are tailored for small businesses while some are more complete. Jirav is an example of a cloud-based financial planning platform. It allows accounting teams to budget and forecast without using spreadsheets. It's customizable and eliminates manual, tedious processes. Jirav is best for small businesses. Board, another popular financial platform, unites metrics, analysis, and reports to assist financial planners making better decisions.

These types of software are beneficial to financial advisors. Individuals can also benefit. These tools can help individuals track their finances, develop an investment profile, and pay bills. Do your research on financial planning software before buying.

FAQ

What does a financial planner do?

A financial planner will help you develop a financial plan. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners, who are qualified professionals, can help you to create a sound financial strategy. They can help you determine how much to save each month and which investments will yield the best returns.

Most financial planners receive a fee based upon the value of their advice. However, there are some planners who offer free services to clients who meet specific criteria.

Who can help with my retirement planning

Retirement planning can be a huge financial problem for many. This is not only about saving money for yourself, but also making sure you have enough money to support your family through your entire life.

The key thing to remember when deciding how much to save is that there are different ways of calculating this amount depending on what stage of your life you're at.

If you're married, you should consider any savings that you have together, and make sure you also take care of your personal spending. If you are single, you may need to decide how much time you want to spend on your own each month. This figure can then be used to calculate how much should you save.

If you are working and wish to save now, you can set up a regular monthly pension contribution. Consider investing in shares and other investments that will give you long-term growth.

Talk to a financial advisor, wealth manager or wealth manager to learn more about these options.

How to Start Your Search for a Wealth Management Service

When searching for a wealth management service, look for one that meets the following criteria:

-

A proven track record

-

Is it based locally

-

Free consultations

-

Supports you on an ongoing basis

-

Clear fee structure

-

Good reputation

-

It is simple to contact

-

Support available 24/7

-

A variety of products are available

-

Low fees

-

Does not charge hidden fees

-

Doesn't require large upfront deposits

-

You should have a clear plan to manage your finances

-

You have a transparent approach when managing your money

-

Makes it easy for you to ask questions

-

Have a good understanding of your current situation

-

Understanding your goals and objectives

-

Are you open to working with you frequently?

-

Works within your budget

-

Have a solid understanding of the local marketplace

-

Are you willing to give advice about how to improve your portfolio?

-

Are you willing to set realistic expectations?

Who Should Use A Wealth Manager?

Everyone who wishes to increase their wealth must understand the risks.

New investors might not grasp the concept of risk. Poor investment decisions can lead to financial loss.

It's the same for those already wealthy. Some may believe they have enough money that will last them a lifetime. But this isn't always true, and they could lose everything if they aren't careful.

Everyone must take into account their individual circumstances before making a decision about whether to hire a wealth manager.

How to Choose An Investment Advisor

Choosing an investment advisor is similar to selecting a financial planner. Consider experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees represent the cost of the service. It is important to compare the costs with the potential return.

It is crucial to find an advisor that understands your needs and can offer you a plan that works for you.

How do I get started with Wealth Management?

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many Wealth Management services, but most people fall within one of these three categories.

-

Investment Advisory Services - These professionals will help you determine how much money you need to invest and where it should be invested. They also provide investment advice, including portfolio construction and asset allocation.

-

Financial Planning Services- This professional will assist you in creating a comprehensive plan that takes into consideration your goals and objectives. Based on their expertise and experience, they may recommend investments.

-

Estate Planning Services - A lawyer who is experienced can help you to plan for your estate and protect you and your loved ones against potential problems when you pass away.

-

Ensure that a professional is registered with FINRA before hiring them. Find someone who is comfortable working alongside them if you don't feel like it.

What is risk management and investment management?

Risk management is the art of managing risks through the assessment and mitigation of potential losses. It involves monitoring and controlling risk.

An integral part of any investment strategy is risk management. The objective of risk management is to reduce the probability of loss and maximize the expected return on investments.

These are the core elements of risk management

-

Identifying the sources of risk

-

Measuring and monitoring the risk

-

Controlling the Risk

-

Managing the risk

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

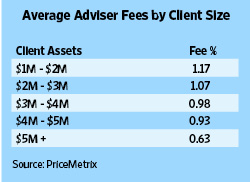

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

External Links

How To

How to beat inflation using investments

Inflation can be a major factor in your financial security. It has been observed that inflation is increasing steadily over the past few years. The rate of increase varies across countries. For example, India is facing a much higher inflation rate than China. This means that even though you may have saved money, your future income might not be sufficient. If you do not invest regularly, then you risk losing out on opportunities to earn more income. How can you manage inflation?

Stocks are one way to beat inflation. Stocks can offer a high return on your investment (ROI). You can also use these funds for real estate, gold, silver, and any other asset that promises a higher ROI. Before you invest in stocks, there are a few things you should consider.

First of all, you need to decide what type of stock market it is that you want. Do you prefer small or large-cap businesses? Then choose accordingly. Next, consider the nature of your stock market. Are you looking for growth stocks or values stocks? Then choose accordingly. Learn about the risks associated with each stock market. There are many kinds of stocks in today's stock market. Some are dangerous, others are safer. Be wise.

Get expert advice if you're planning on investing in the stock market. They will be able to tell you if you have made the right decision. Diversifying your portfolio is a must if you want to invest on the stock markets. Diversifying can increase your chances for making a good profit. You risk losing everything if only one company invests in your portfolio.

You can consult a financial advisor if you need further assistance. These professionals will assist you in the stock investing process. They will help ensure that you choose the right stock. They can help you determine when it is time to exit stock markets, depending upon your goals and objectives.